FLSA – Changes on the Horizon

April 10, 2015

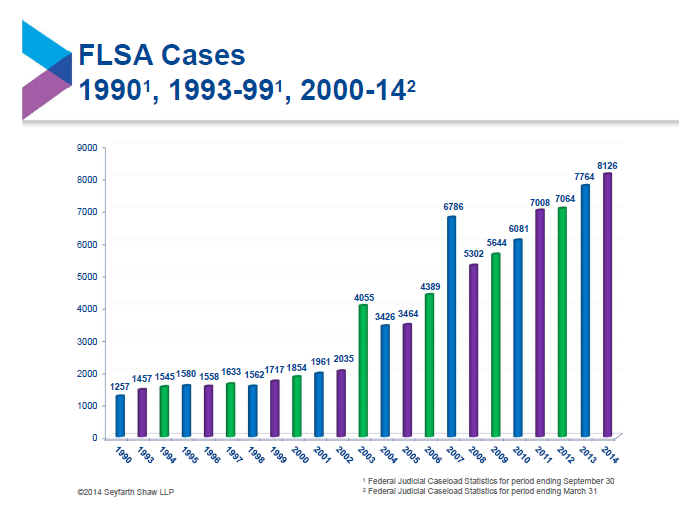

On March 13th, 2014 the White House, Office of the Press Secretary released the Fact Sheet: Opportunity for All: Rewarding Hard Work by Strengthening Overtime Protections. As an excerpt from the fact sheet states, “The overtime and minimum wage rules are set in the Fair Labor Standards Act, originally passed by Congress in 1938, and apply broadly to private-sector workers. However, there are some exceptions to these rules, which the Department of Labor has the authority to define through regulation. One of the most commonly used exemptions is for “executive, administrative and professional” employees, the so-called “white collar” exemption.” A Presidential Memorandum has been signed instructing the Secretary of Labor to update regulations regarding who qualifies for overtime protection. By possibly changing the rules as to who qualifies as exempt vs. non-exempt from overtime, in what may be a new form of “duties test”, as well as the possibility of the income threshold for salary being raised; many employers are sure to have questions, and many more employers are sure to be exposed to further FLSA cases.

A draft of the new regulations was originally promised for November of 2014, but has been continually pushed back. That does not mean they won’t happen; in fact Secretary Perez has stated that they will be released this “sometime this spring.” Though the draft of the new regulations has not been released, it is always a good time for employers to review how they currently classify employees, as the main changes expected are to be in the form of a new “duties” test for salaried employees. Employers should also be prepared for the way the changes will affect their overtime wages paid. Changes to a base salary requirement (many think it will at least double from the current $455 per week) along with the duties test are sure to have more employees classified as non-exempt for overtime, and therefore employers should be prepared for more wages paid out to employees in the form of overtime wages.

As always HR Strategies can help you reduce your risk and vulnerabilities to a FLSA regulations lawsuit, along with the many other Federal, State, Local and Professional Regulatory changes. Call us today to relieve your stress of whether or not you are in compliance; and give yourself the ability to focus on the aspects of your company for which you went into business, while we handle the behind the scenes issue of compliance.

On March 13th, 2014 the White House, Office of the Press Secretary released the Fact Sheet: Opportunity for All: Rewarding Hard Work by Strengthening Overtime Protections. As an excerpt from the fact sheet states, “The overtime and minimum wage rules are set in the Fair Labor Standards Act, originally passed by Congress in 1938, and apply broadly to private-sector workers. However, there are some exceptions to these rules, which the Department of Labor has the authority to define through regulation. One of the most commonly used exemptions is for “executive, administrative and professional” employees, the so-called “white collar” exemption.” A Presidential Memorandum has been signed instructing the Secretary of Labor to update regulations regarding who qualifies for overtime protection. By possibly changing the rules as to who qualifies as exempt vs. non-exempt from overtime, in what may be a new form of “duties test”, as well as the possibility of the income threshold for salary being raised; many employers are sure to have questions, and many more employers are sure to be exposed to further FLSA cases.

A draft of the new regulations was originally promised for November of 2014, but has been continually pushed back. That does not mean they won’t happen; in fact Secretary Perez has stated that they will be released this “sometime this spring.” Though the draft of the new regulations has not been released, it is always a good time for employers to review how they currently classify employees, as the main changes expected are to be in the form of a new “duties” test for salaried employees. Employers should also be prepared for the way the changes will affect their overtime wages paid. Changes to a base salary requirement (many think it will at least double from the current $455 per week) along with the duties test are sure to have more employees classified as non-exempt for overtime, and therefore employers should be prepared for more wages paid out to employees in the form of overtime wages.

As always HR Strategies can help you reduce your risk and vulnerabilities to a FLSA regulations lawsuit, along with the many other Federal, State, Local and Professional Regulatory changes. Call us today to relieve your stress of whether or not you are in compliance; and give yourself the ability to focus on the aspects of your company for which you went into business, while we handle the behind the scenes issue of compliance.

Give us a call today! 770-339-0000